Stein Mart Files Chapter 11 Bankruptcy

On August 12, 2020, Stein Mart declared Chapter 11 bankruptcy. The discount retailer is one of many large companies to seek the protections of Chapter 11 since the onset of the coronavirus pandemic. The company’s future is uncertain and employees are preparing for the end of business.

On August 12, 2020, Stein Mart declared Chapter 11 bankruptcy. The discount retailer is one of many large companies to seek the protections of Chapter 11 since the onset of the coronavirus pandemic. The company’s future is uncertain and employees are preparing for the end of business.

What Led to Stein Mart’s Demise

Stein Mart has been in business since 1908. It has since grown to 280 locations across 30 states. The company will continue to operate for the foreseeable future, but will likely hold a going out of business sale starting the weekend after the bankruptcy was filed. Unless the company finds a buyer, CEO Hunt Hawkins predicts that the chain will be fully closed by October.

Stein Mart was already facing financial struggles before the start of the pandemic. Sales at the beginning of this year were $134 million, compared to $314 million for the same period the year prior. Then on March 18, 2020, Stein Mart closed all of its locations in accordance with COVID-19 social isolation guidelines. While locations have begun to reopen with restrictions, the damage has already been done. The company reported approximately $200 million in debts in May 2020. Stein Mart borrowed $10 million for a payroll protection loan under the Coronavirus Aid, Relief and Economic Security (CARES) Act.

Stein Mart has approximately 8,000 employees who have been furloughed for the past few months, and will need to start looking for new employment. Thankfully for these Stein Mart employees, the extra $600 weekly federal benefit provided by the CARES Act, which was originally set to expire on July 31, 2020, has been extended at a reduced rate of $400 per week until January 31, 2020.

Business owners considering Chapter 11 need to remember how expensive and complicated of a process it can be. Stein Mart has hired three separate firms for advice and guidance during the Chapter 11 process. Foley & Larder is Stein Mart’s restructuring counsel, Clear Thinking Group is its restructuring adviser, and PJ Solomon is its investment advisor. The company’s stock fell 35% upon filing.

Chapter 11 Bankruptcy, Explained

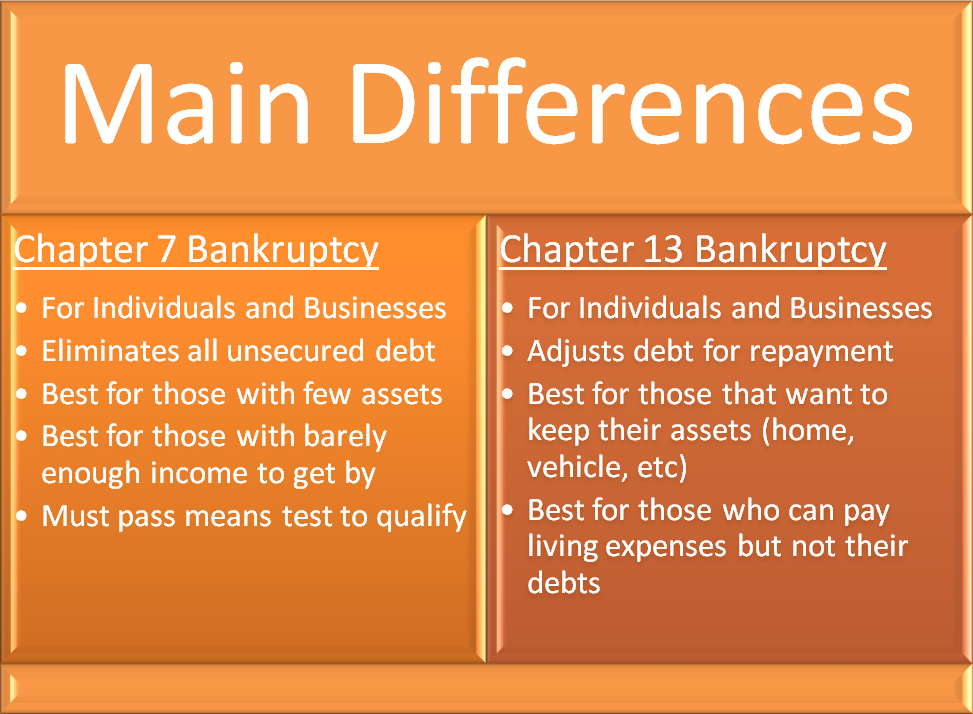

While it appears that Stein Mart will be shutting down for good through its bankruptcy filing, Chapter 11 doesn’t require that of a business that files. A company will typically choose Chapter 11 when it wants to remodel the business, because the other option, Chapter 7, requires the business to close and surrender all assets. Once a company files Chapter 11, its main creditors will form a committee that will have authority over major business decisions. The company will submit a plan to the committee on how it should restructure its debt and emerge from bankruptcy. If the committee doesn’t agree to the plan, they may submit their own.

While it appears that Stein Mart will be shutting down for good through its bankruptcy filing, Chapter 11 doesn’t require that of a business that files. A company will typically choose Chapter 11 when it wants to remodel the business, because the other option, Chapter 7, requires the business to close and surrender all assets. Once a company files Chapter 11, its main creditors will form a committee that will have authority over major business decisions. The company will submit a plan to the committee on how it should restructure its debt and emerge from bankruptcy. If the committee doesn’t agree to the plan, they may submit their own.

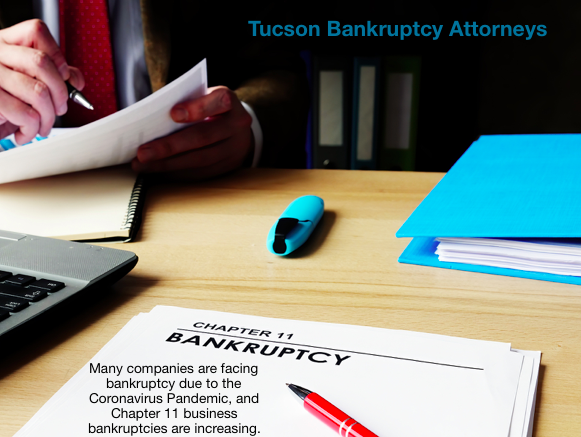

Chapter 11 has become even more prevalent in this COVID-19 climate. It is a pandemic like no other in recent memory, Many people throughout Tucson, Arizona, and the United States are dealing with tough economic times. Seek assistance if you are struggling to make ends meet. There are a myriad of Tucson Debt Relief options available.

Other Popular Companies to Declare Bankruptcy During the Coronavirus Pandemic

So far, 2020 has seen a 26% increase in Chapter 11 bankruptcy filings. Some of these include: