Ask Our Tucson Chapter 13 Bankruptcy Lawyers

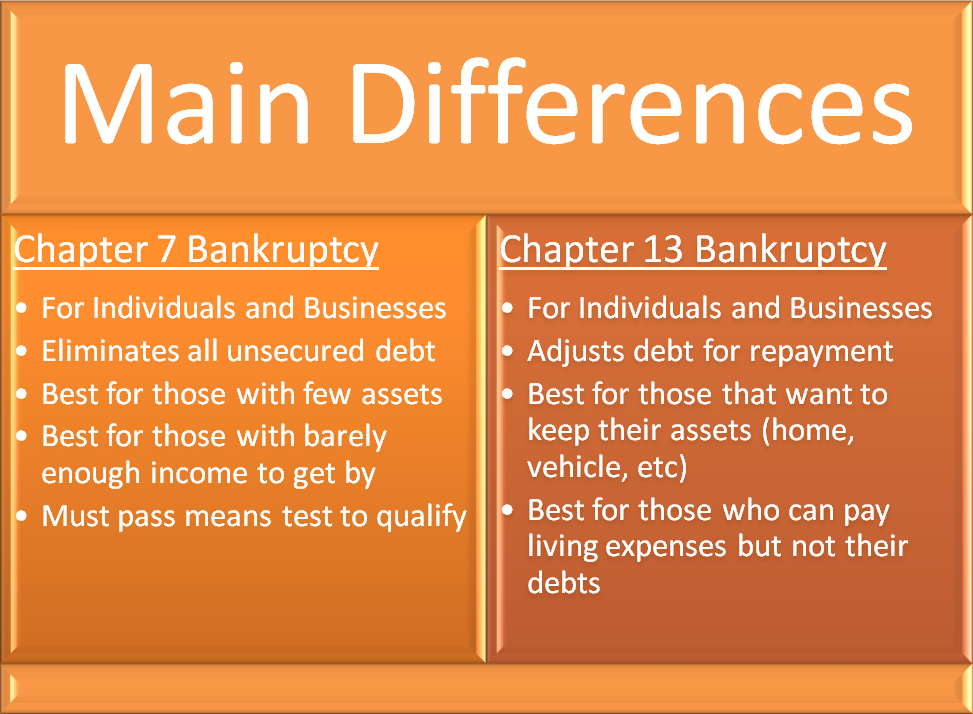

Knowing when to file chapter 13 bankruptcy is an important fact to know if you are considering filing for bankruptcy in Tucson, Arizona. When choosing to file for bankruptcy in Tucson, there are 2 main chapters of bankruptcy that most people file. They are chapter 7 bankruptcy and chapter 13 bankruptcy.

Chapter 13 bankruptcy is generally used if:

• You have a house in foreclosure that you want to keep

• Your income exceeds your expenses and does not allow you?to file for Chapter 7 Bankruptcy

• If you have some other large non-exempt assets that you would like to retain

** Chapter 13 bankruptcy: requires a repayment of part of your debts in a percentage that you propose to the Bankruptcy Court.

When drawing up your chapter 13 bankruptcy repayment plan, you and your attorney prepare a plan for repayment of your debts with monthly payments that you can afford. Chapter 13 bankruptcy allows you to set up an affordable plan for repaying a portion of your debt to your creditors. The chapter 13 bankruptcy payment plan is customized to your unique situation. It is affordable because you pay your living expenses first, then any remaining income is divided among your creditors.

Chapter 13 bankruptcy repayment plans usually last between 3 and 5 years and repay creditors anywhere between 10% – 100% of what is owed for unsecured debt, such as credit cards, medical bills, etc.

Though you can file for chapter 13 bankruptcy without using an experienced chapter 13 bankruptcy lawyer, it is definitely not recommended. Even a document preparation company will struggle mightily with a chapter 13 bankruptcy filing. Seek the assistance of a knowledgeable bankruptcy attorney in Tucson, Arizona.

The chapter 13 bankruptcy plan must be approved by the Bankruptcy Court and place your unsecured creditors in at least as good of a position as they would be in a Chapter 7 Bankruptcy.

In some circumstances, a Chapter 13 can be used to strip a second mortgage from your home if the first mortgage exceeds the current value of your home. Chapter 13 bankruptcy can also be a valuable assistance in pausing your student loan payments and in stopping the repossession of a vehicle.

When to Choose Chapter 13 Bankruptcy

When to Choose Chapter 13 Bankruptcy

In order to determine if a Chapter 13 Bankruptcy is right for you, please contact My AZ lawyers, PLLC. Our experienced Tucson bankruptcy lawyers will assist you in choosing the best chapter of bankruptcy for you to file and advise you as to all of your debt relief options. We offer Free Consultations (Either in Office or by Phone — Your Choice!). Contact our Tucson bankruptcy law office now!